8.3 Exercises

8.3.1 Exercise 5

Data set global_economy contains the annual Exports from many countries.

8.3.1.1 Select one country to analyse.

## # A tsibble: 6 x 9 [1Y]

## # Key: Country [1]

## Country Code Year GDP Growth CPI Imports Exports Population

## <fct> <fct> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 Italy ITA 1960 40385288344. NA 4.15 12.9 12.5 50199700

## 2 Italy ITA 1961 44842760293. 8.21 4.23 12.9 12.8 50536350

## 3 Italy ITA 1962 50383891899. 6.20 4.43 13.2 12.7 50879450

## 4 Italy ITA 1963 57710743060. 5.61 4.76 14.3 12.2 51252000

## 5 Italy ITA 1964 63175417019. 2.80 5.04 12.7 12.8 51675350

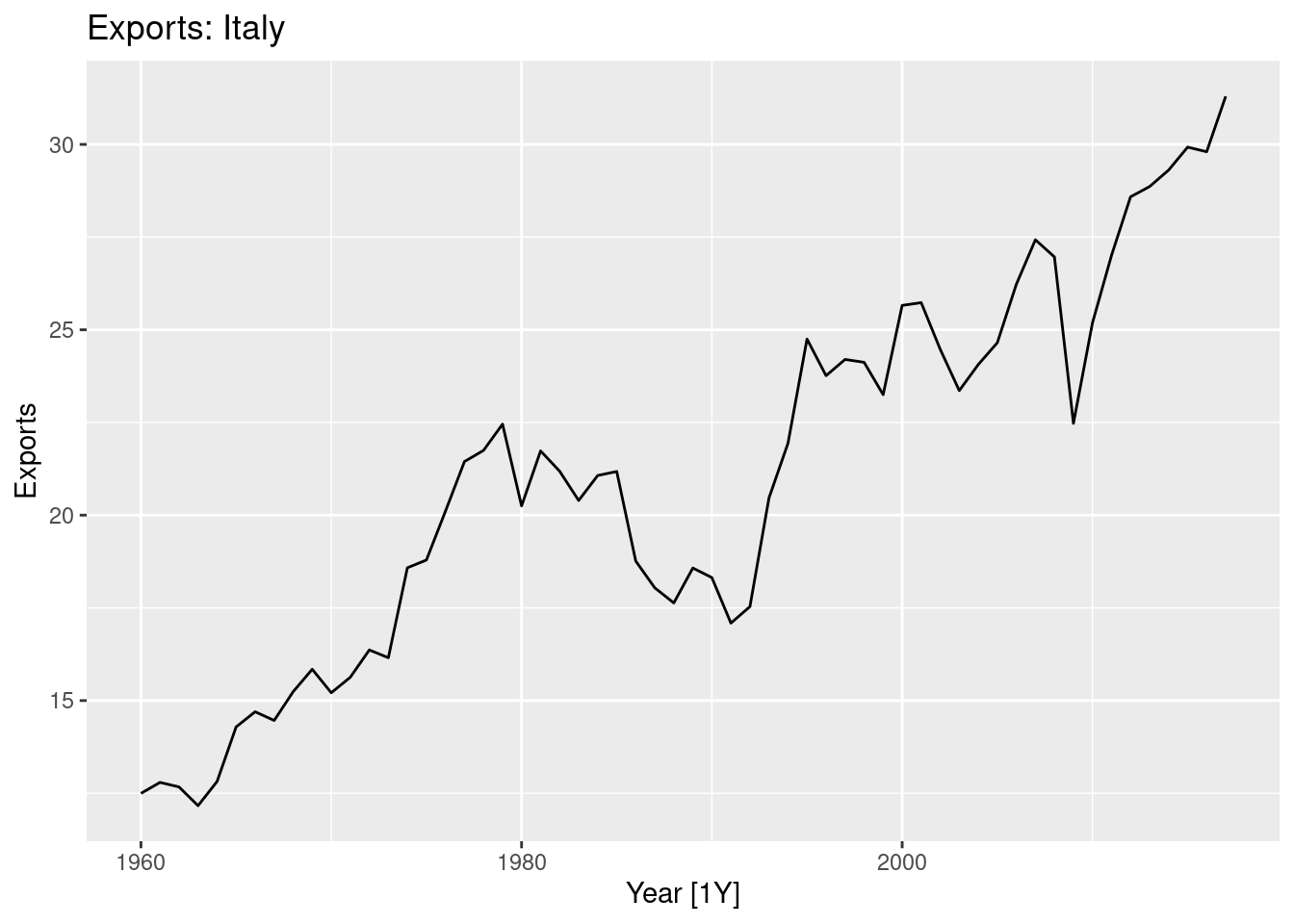

## 6 Italy ITA 1965 67978153851. 3.27 5.27 12.1 14.3 521123508.3.1.2 Plot the Exports series and discuss the main features of the data.

## # A tsibble: 6 x 9 [1Y]

## # Key: Country [1]

## Country Code Year GDP Growth CPI Imports Exports Population

## <fct> <fct> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 Italy ITA 2012 2.07e12 -2.82 106. 27.6 28.6 59539717

## 2 Italy ITA 2013 2.13e12 -1.73 107. 26.6 28.9 60233948

## 3 Italy ITA 2014 2.15e12 0.114 107. 26.5 29.3 60789140

## 4 Italy ITA 2015 1.83e12 0.952 107. 27.0 29.9 60730582

## 5 Italy ITA 2016 1.86e12 0.858 107. 26.5 29.8 60627498

## 6 Italy ITA 2017 1.93e12 1.50 109. 28.2 31.3 605514168.3.1.3 Use an ETS(A,N,N) model to forecast the series, and plot the forecasts.

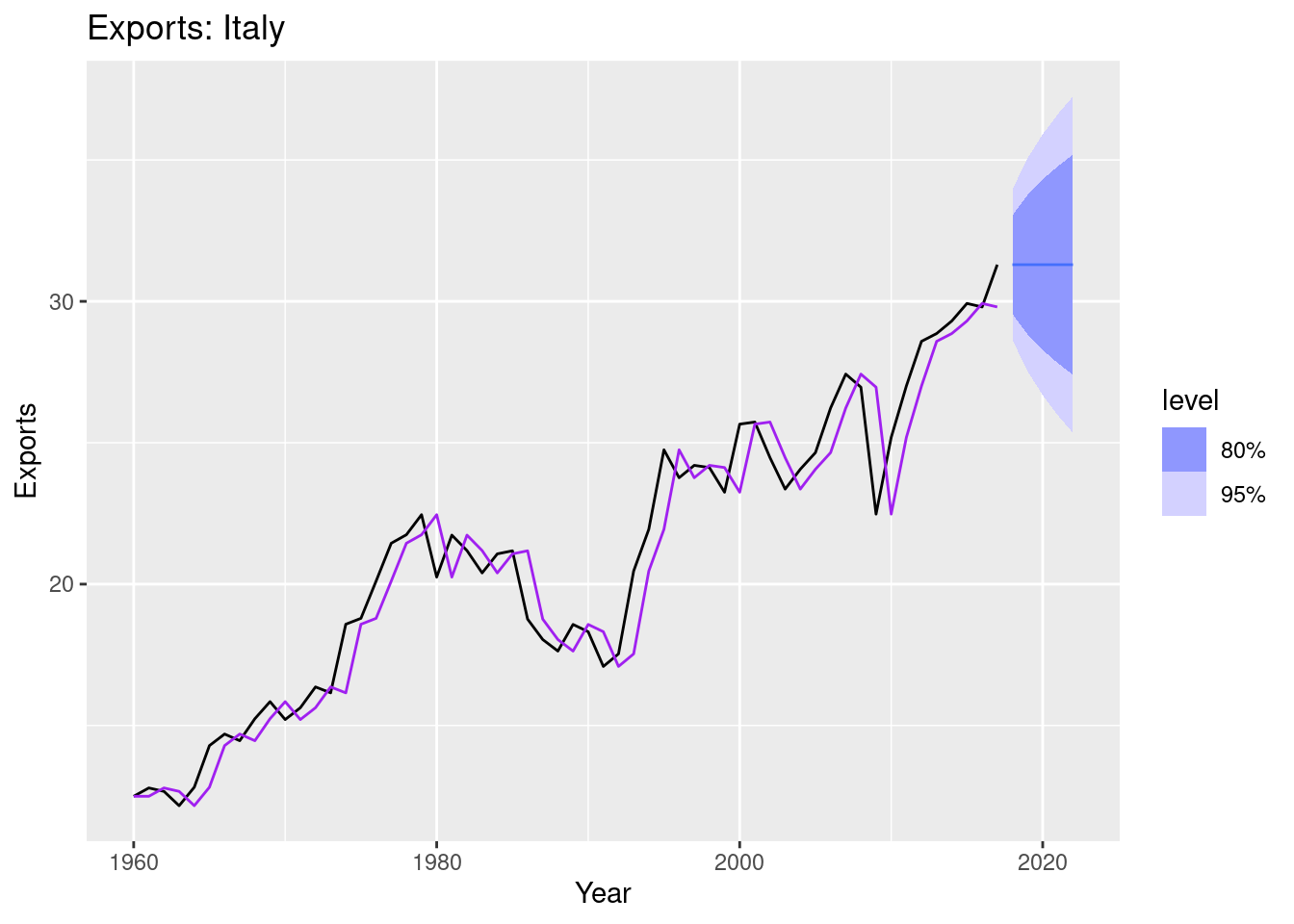

# Estimate parameters

fit <- italy_economy |>

model(ETS(Exports ~ error("A") + trend("N") + season("N")))

fit %>% tidy()## # A tibble: 2 × 4

## Country .model term estimate

## <fct> <chr> <chr> <dbl>

## 1 Italy "ETS(Exports ~ error(\"A\") + trend(\"N\") + season(\"… alpha 1.00

## 2 Italy "ETS(Exports ~ error(\"A\") + trend(\"N\") + season(\"… l[0] 12.5fc |>

autoplot(italy_economy) +

geom_line(aes(y = .fitted), col="purple",

data = augment(fit)) +

labs(y="Exports", title="Exports: Italy") +

guides(colour = "none")

8.3.1.4 Compute the RMSE values for the training data.

## # A tsibble: 58 x 9 [1Y]

## # Key: Country [1]

## Country Code Year GDP Growth CPI Imports Exports Population

## <fct> <fct> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 Italy ITA 1960 40385288344. NA 4.15 12.9 12.5 50199700

## 2 Italy ITA 1961 44842760293. 8.21 4.23 12.9 12.8 50536350

## 3 Italy ITA 1962 50383891899. 6.20 4.43 13.2 12.7 50879450

## 4 Italy ITA 1963 57710743060. 5.61 4.76 14.3 12.2 51252000

## 5 Italy ITA 1964 63175417019. 2.80 5.04 12.7 12.8 51675350

## 6 Italy ITA 1965 67978153851. 3.27 5.27 12.1 14.3 52112350

## 7 Italy ITA 1966 73654870011. 5.98 5.39 13.0 14.7 52519000

## 8 Italy ITA 1967 81133120065. 7.18 5.60 13.5 14.5 52900500

## 9 Italy ITA 1968 87942231678. 6.54 5.67 13.3 15.2 53235750

## 10 Italy ITA 1969 97085082807. 6.10 5.82 14.5 15.8 53537950

## # ℹ 48 more rowsitaly_economy %>%

model(ETS(Exports ~ error("A") + trend("N") + season("N"))) |>

fabletools::accuracy()## # A tibble: 1 × 11

## Country .model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

## <fct> <chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 Italy "ETS(Exports… Trai… 0.324 1.34 1.00 1.39 4.75 0.983 0.991 -0.00701italy_economy %>%

as_tsibble() %>%

# Perform stretching windows on a tsibble by row

stretch_tsibble(.init = 10) |>

model(ETS(Exports ~ error("A") + trend("N") + season("N"))) |>

forecast(h = 1) |>

fabletools::accuracy(italy_economy) ## Warning: The future dataset is incomplete, incomplete out-of-sample data will be treated as missing.

## 1 observation is missing at 2018## # A tibble: 1 × 11

## .model Country .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

## <chr> <fct> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 "ETS(Exports … Italy Test 0.321 1.44 1.11 1.20 5.01 1.09 1.07 0.001078.3.1.5 Compare the results to those from an ETS(A,A,N) model.

italy_economy %>%

model(ETS(Exports ~ error("A") + trend("N") + season("N")),

ETS(Exports ~ error("A") + trend("A") + season("N"))) |>

fabletools::accuracy()%>%

select(.model,.type,RMSE)## # A tibble: 2 × 3

## .model .type RMSE

## <chr> <chr> <dbl>

## 1 "ETS(Exports ~ error(\"A\") + trend(\"N\") + season(\"N\"))" Training 1.34

## 2 "ETS(Exports ~ error(\"A\") + trend(\"A\") + season(\"N\"))" Training 1.30italy_economy |>

as_tsibble() |>

# Perform stretching windows on a tsibble by row

stretch_tsibble(.init = 10) |>

model(SES = ETS(Exports ~ error("A") + trend("N") + season("N")),

Holt = ETS(Exports ~ error("A") + trend("A") + season("N")),

Damped = ETS(Exports ~ error("A") + trend("Ad") + season("N")))|>

forecast(h = 1) |>

fabletools::accuracy(italy_economy) ## Warning: The future dataset is incomplete, incomplete out-of-sample data will be treated as missing.

## 1 observation is missing at 2018## # A tibble: 3 × 11

## .model Country .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

## <chr> <fct> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 Damped Italy Test 0.144 1.51 1.14 0.411 5.17 1.12 1.12 0.0800

## 2 Holt Italy Test 0.0562 1.52 1.15 0.0414 5.26 1.13 1.13 0.0566

## 3 SES Italy Test 0.321 1.44 1.11 1.20 5.01 1.09 1.07 0.00107(Remember that the trended model is using one more parameter than the simpler model.)

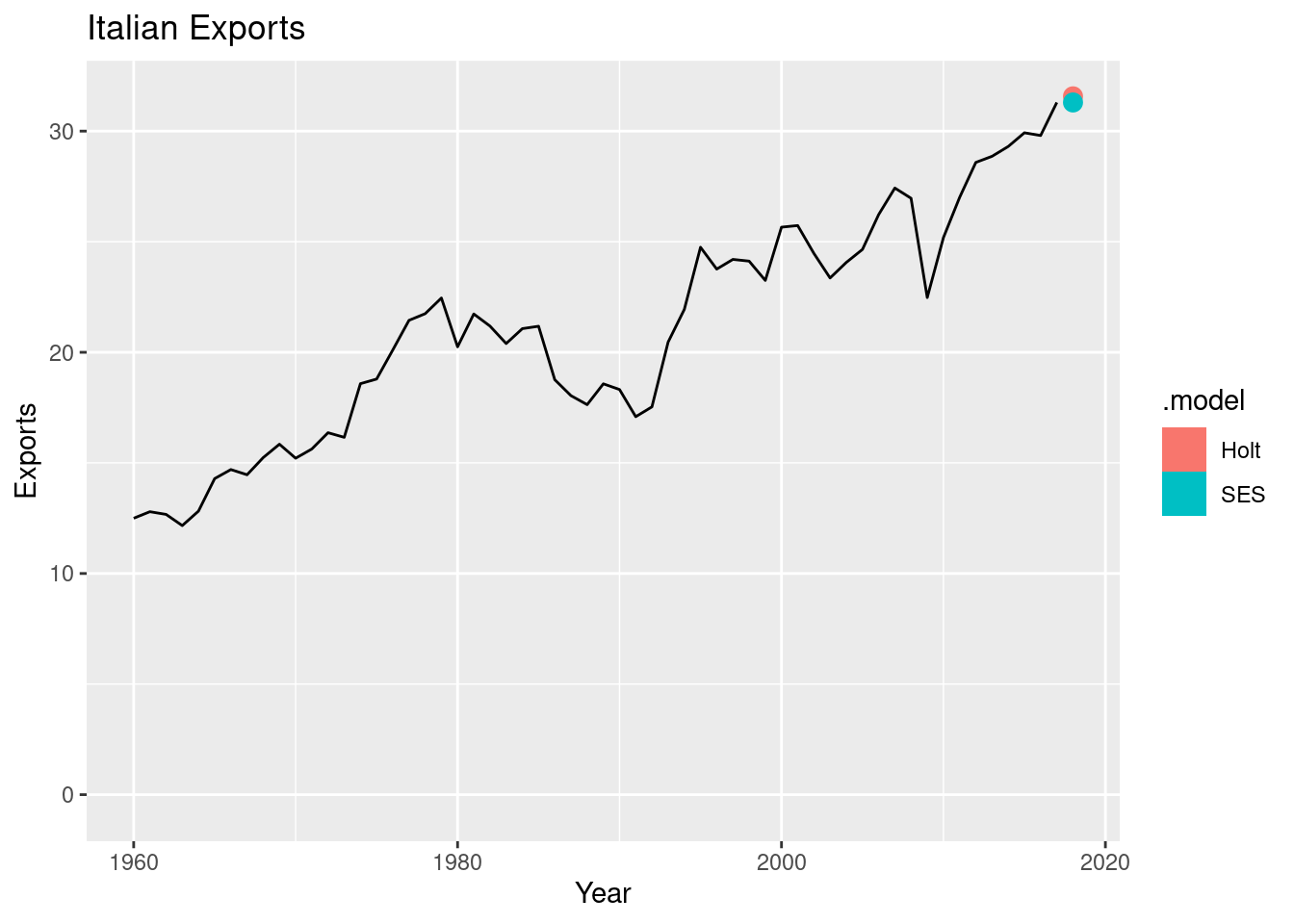

Discuss the merits of the two forecasting methods for this data set.

8.3.1.6 Compare the forecasts from both methods.

Which do you think is best?

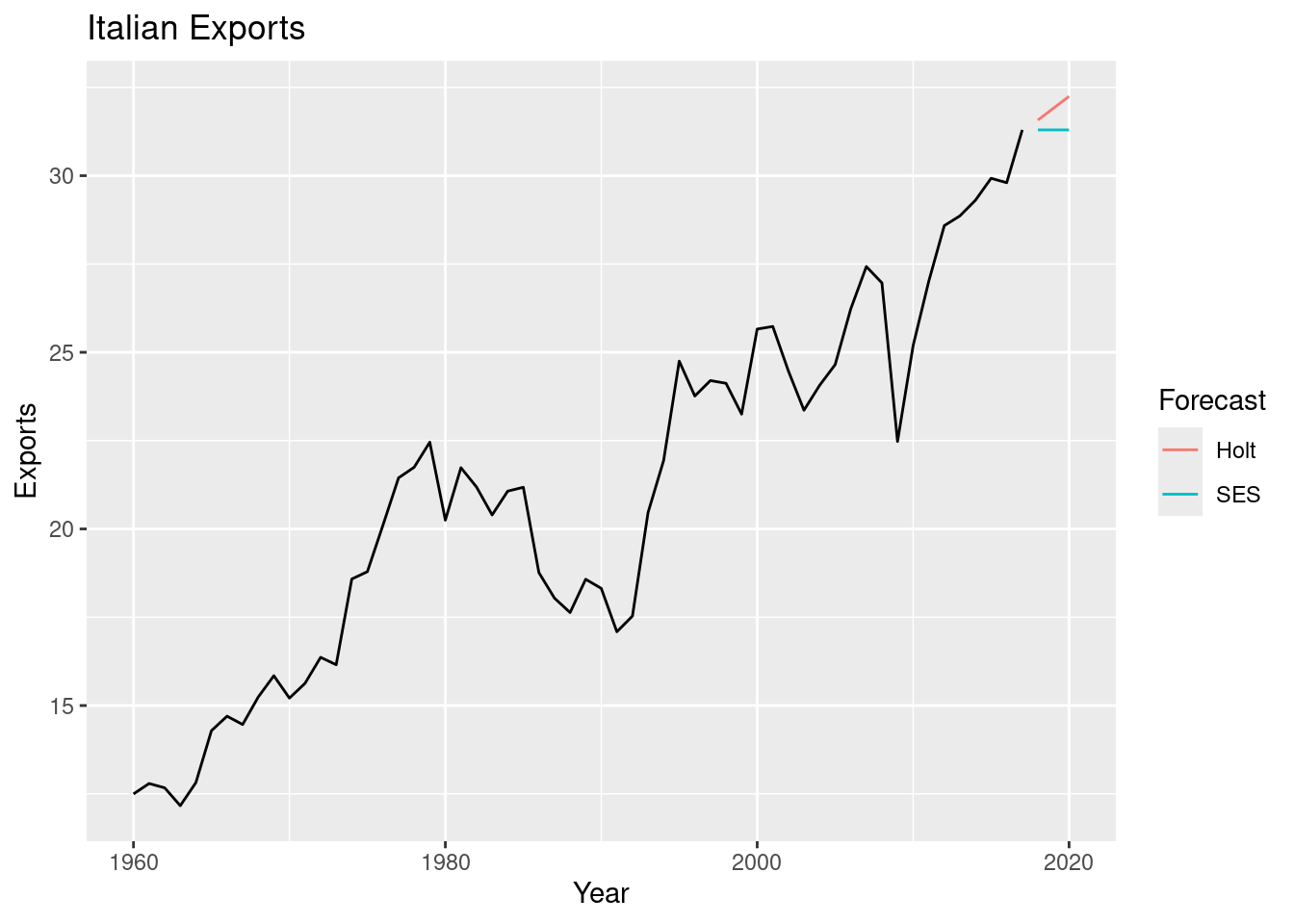

fit <- italy_economy |>

model(

SES = ETS(Exports ~ error("A") + trend("N") + season("N")),

Holt = ETS(Exports ~ error("A") + trend("A") + season("N"))

)

fc <- fit |> forecast(h = "3 years")

fc |>

autoplot(italy_economy, level = NULL) +

labs(title="Italian Exports",

y="Exports") +

guides(colour = guide_legend(title = "Forecast"))

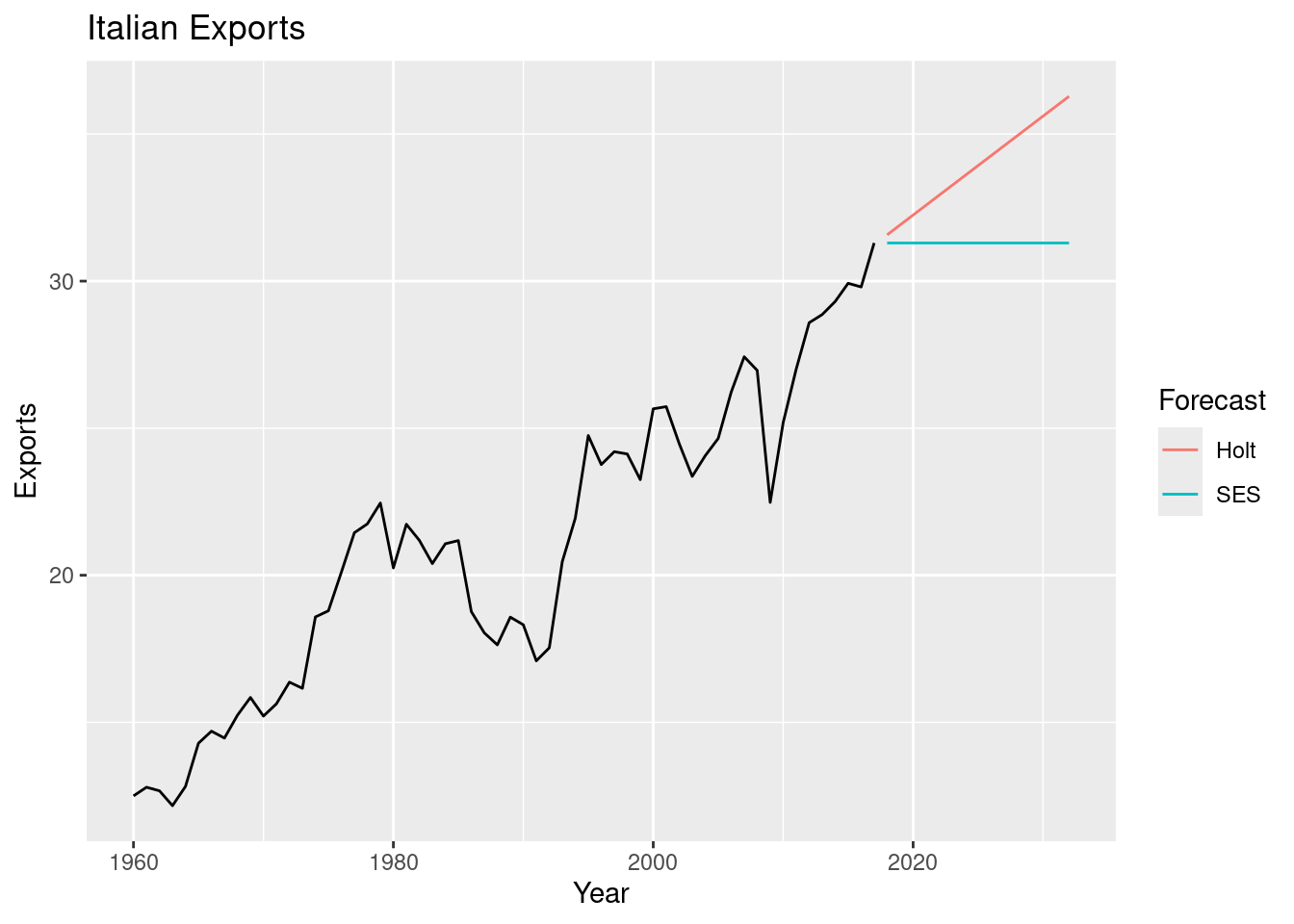

italy_economy |>

model(

SES = ETS(Exports ~ error("A") + trend("N") + season("N")),

Holt = ETS(Exports ~ error("A") + trend("A") + season("N"))

) |>

forecast(h = 15) |>

autoplot(italy_economy, level = NULL) +

labs(title = "Italian Exports",

y = "Exports") +

guides(colour = guide_legend(title = "Forecast"))

Calculate a 95% prediction interval for the first forecast for each model, using the RMSE values and assuming normal errors.

fit |>

forecast(h = 1) |>

autoplot(italy_economy) +

labs(x="Year", y="Exports",

title = "Italian Exports")## Warning in min(x, na.rm = na.rm): no non-missing arguments to min; returning

## Inf## Warning in max(x, na.rm = na.rm): no non-missing arguments to max; returning

## -Inf## Warning in min(x, na.rm = na.rm): no non-missing arguments to min; returning

## Inf## Warning in max(x, na.rm = na.rm): no non-missing arguments to max; returning

## -Inf## Warning in min(x, na.rm = na.rm): no non-missing arguments to min; returning

## Inf## Warning in max(x, na.rm = na.rm): no non-missing arguments to max; returning

## -Inf

## # A fable: 2 x 5 [1Y]

## # Key: Country, .model [2]

## Country .model Year Exports .mean

## <fct> <chr> <dbl> <dist> <dbl>

## 1 Italy SES 2018 N(31, 1.8) 31.3

## 2 Italy Holt 2018 N(32, 1.8) 31.6Compare your intervals with those produced using R.

Prediction intervals A prediction interval gives an interval within which we expect \(y_t\) to lie with a specified probability. For example, assuming that distribution of future observations is normal, a 95% prediction interval for the \(h\) step forecast is:

\[\hat{y}_{T+h|T} \pm 1.96 \hat{\sigma}_h\]

italy_economy |>

model(

SES = ETS(Exports ~ error("A") + trend("N") + season("N")),

Holt = ETS(Exports ~ error("A") + trend("A") + season("N"))

) |>

forecast(h = 1) |>

hilo()## # A tsibble: 2 x 7 [1Y]

## # Key: Country, .model [2]

## Country .model Year Exports .mean `80%`

## <fct> <chr> <dbl> <dist> <dbl> <hilo>

## 1 Italy SES 2018 N(31, 1.8) 31.3 [29.55514, 33.03762]80

## 2 Italy Holt 2018 N(32, 1.8) 31.6 [29.85396, 33.29475]80

## # ℹ 1 more variable: `95%` <hilo>