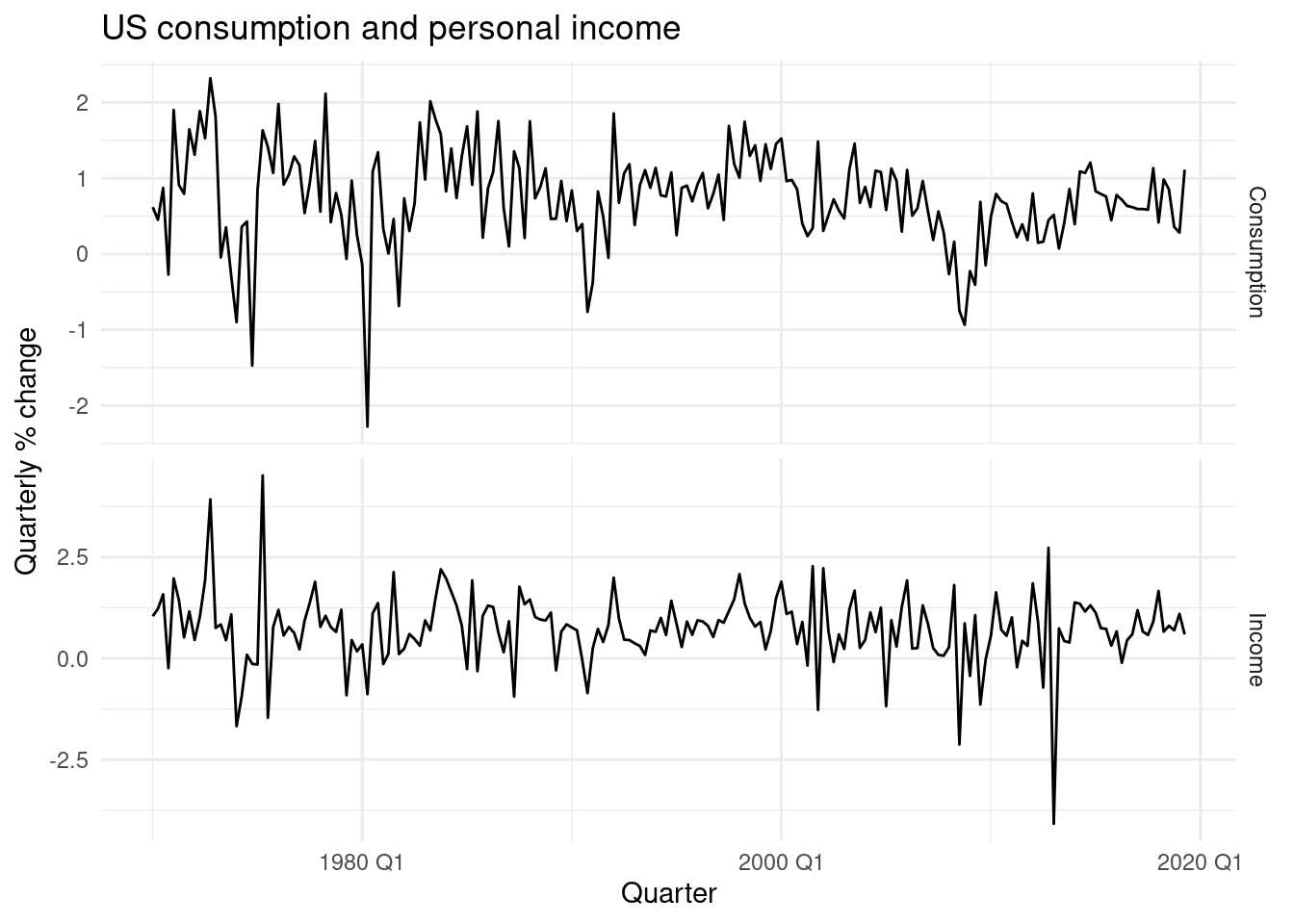

10.3 Example: US Personal Consumption and Income

Forecast changes in expenditure based on changes in income. In this case data are already stationary, and there is no need for any differencing.

library(tidyverse)

library(fpp3)

us_change |>

pivot_longer(c(Consumption, Income),

names_to = "var", values_to = "value") |>

ggplot(aes(x = Quarter, y = value)) +

geom_line() +

facet_grid(vars(var), scales = "free_y") +

labs(title = "US consumption and personal income",

y = "Quarterly % change")

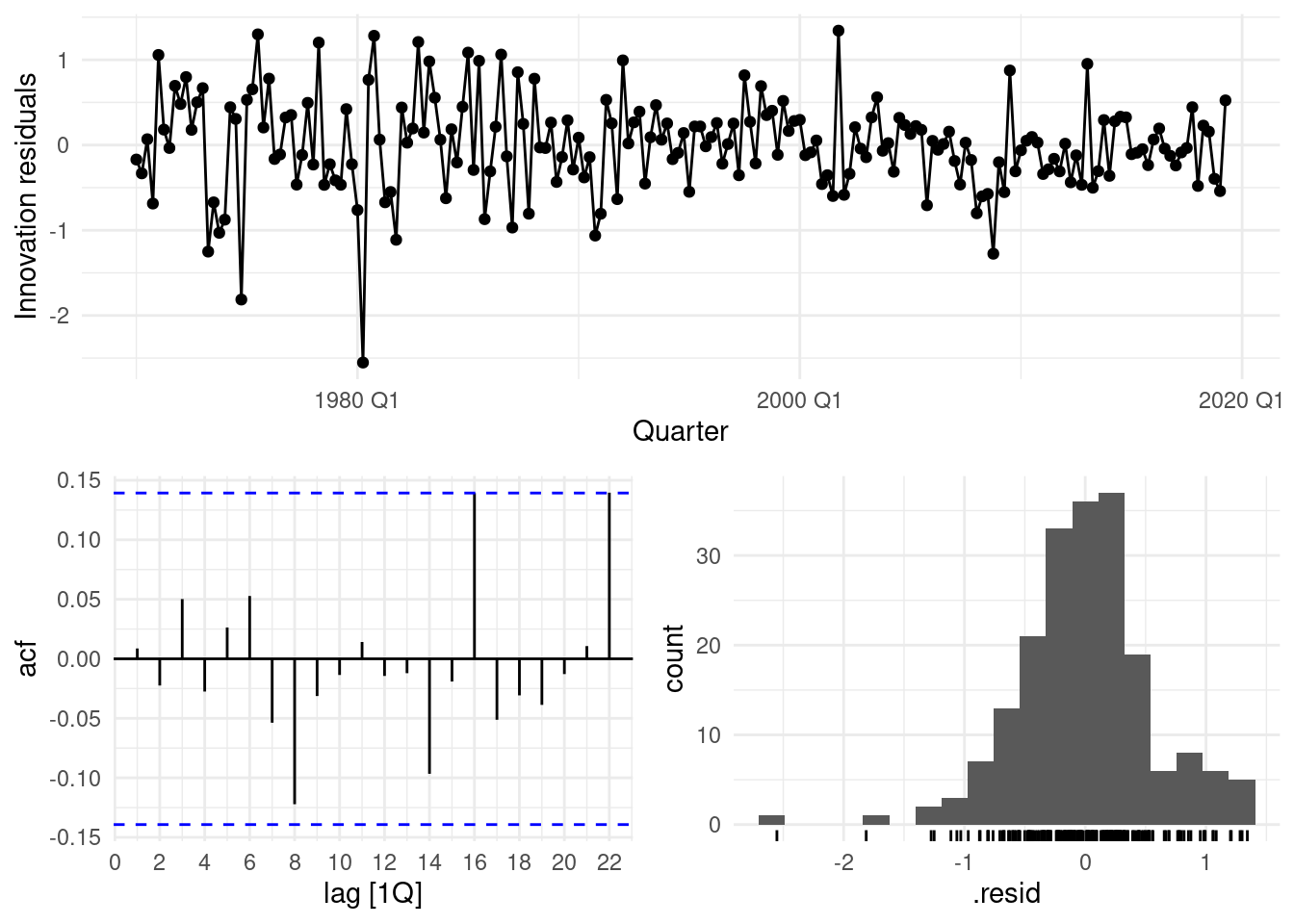

## Series: Consumption

## Model: LM w/ ARIMA(1,0,2) errors

##

## Coefficients:

## ar1 ma1 ma2 Income intercept

## 0.7070 -0.6172 0.2066 0.1976 0.5949

## s.e. 0.1068 0.1218 0.0741 0.0462 0.0850

##

## sigma^2 estimated as 0.3113: log likelihood=-163.04

## AIC=338.07 AICc=338.51 BIC=357.8The model relases this ARIMA model selection: \[ARIMA(1,0,2) \text{ ; errors}\]

\[y_t=0.595+0.198x_t+ \eta_t\] \[\eta_t=0.707 \eta_{t-1}+\varepsilon_t - 0.617 \varepsilon_{t-1}+ 0.207\varepsilon_{t-2}\] \[\varepsilon_t \sim NID(0,0.311)\]

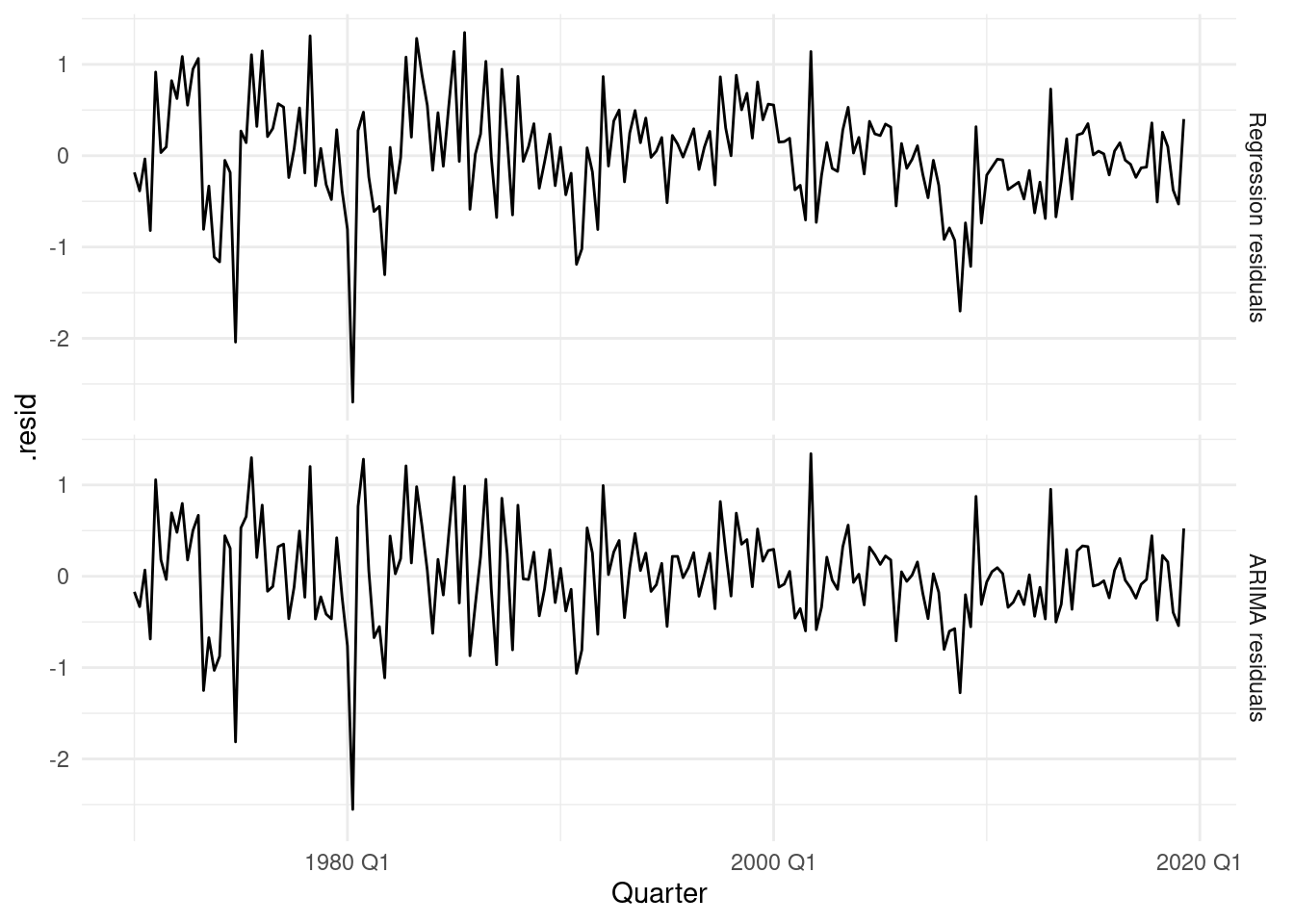

The residual() function applied on the model fit release the estimates for both:

- \(\eta_t\)

- \(\varepsilon_t\)

bind_rows(

`Regression residuals` =

as_tibble(residuals(fit, type = "regression")),

`ARIMA residuals` =

as_tibble(residuals(fit, type = "innovation")),

.id = "type"

) |>

mutate(

type = factor(type, levels=c(

"Regression residuals", "ARIMA residuals"))

) |>

ggplot(aes(x = Quarter, y = .resid)) +

geom_line() +

facet_grid(vars(type))

## # A tibble: 1 × 3

## .model lb_stat lb_pvalue

## <chr> <dbl> <dbl>

## 1 ARIMA(Consumption ~ Income) 5.21 0.391