17.4 How it’s used in Finance

- stock prices reflect information about a company

- short time window

- estimation period before event, observation period from just before the event to the period of interest after event

- use estimation period data to predict \(\hat{R}\) (predicted stock returns)

- means-adjusted returns model

- market-adjusted returns model

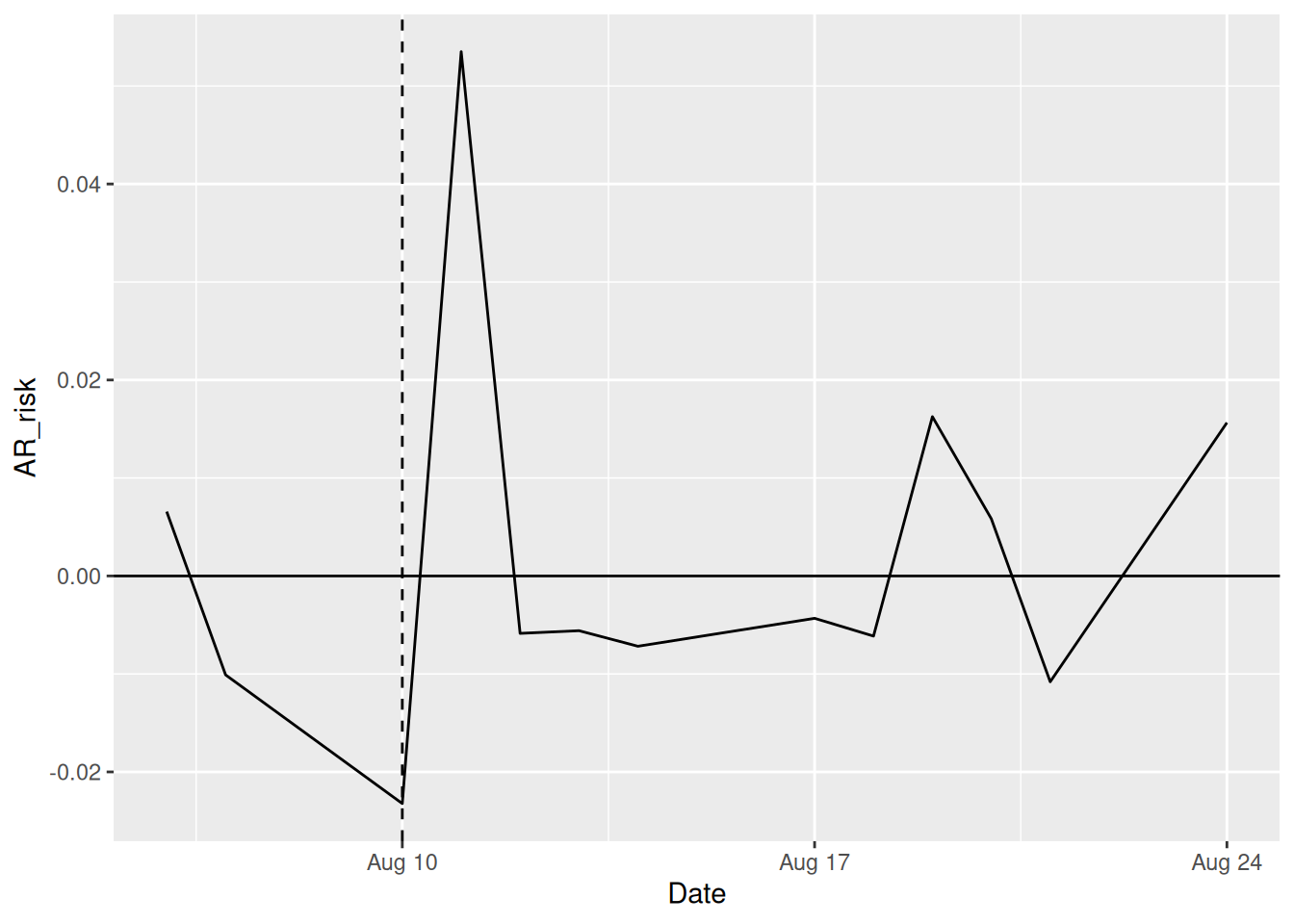

- risk-adjusted returns model

- In observation period: \(AR = R - \hat{R}\) to get abnormal return

- consider AR in observation period

Example

- estimation period: May–July

- observation period: August 6 – August 24

## ── Attaching core tidyverse packages ──────────────────────── tidyverse 2.0.0 ──

## ✔ dplyr 1.1.4 ✔ readr 2.1.5

## ✔ forcats 1.0.0 ✔ stringr 1.5.1

## ✔ ggplot2 3.5.1 ✔ tibble 3.2.1

## ✔ lubridate 1.9.4 ✔ tidyr 1.3.1

## ✔ purrr 1.0.4

## ── Conflicts ────────────────────────────────────────── tidyverse_conflicts() ──

## ✖ dplyr::filter() masks stats::filter()

## ✖ dplyr::lag() masks stats::lag()

## ℹ Use the conflicted package (<http://conflicted.r-lib.org/>) to force all conflicts to become errorsgoog <- causaldata::google_stock

event <- ymd("2015-08-10")

# Create estimation data set

est_data <- goog %>%

filter(Date >= ymd('2015-05-01') &

Date <= ymd('2015-07-31'))

# And observation data

obs_data <- goog %>%

filter(Date >= event - days(4) &

Date <= event + days(14))

# Estimate a model predicting stock price with market return

m <- lm(Google_Return ~ SP500_Return, data = est_data)

# Get AR

obs_data <- obs_data %>%

# Using mean of estimation return

mutate(AR_mean = Google_Return - mean(est_data$Google_Return),

# Then comparing to market return

AR_market = Google_Return - SP500_Return,

# Then using model fit with estimation data

risk_predict = predict(m, newdata = obs_data),

AR_risk = Google_Return - risk_predict)

# Graph the results

ggplot(obs_data, aes(x = Date, y = AR_risk)) +

geom_line() +

geom_vline(aes(xintercept = event), linetype = 'dashed') +

geom_hline(aes(yintercept = 0))